tax deferred exchange definition

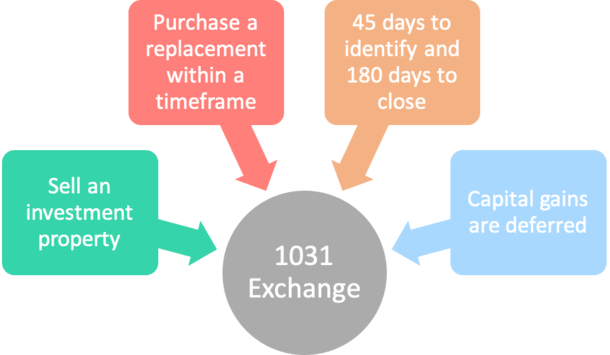

Tax code defines a 1031 exchange as a like-kind exchange of one investment property for another in which capital gains tax liability is deferred. Because capital gains taxes can take a huge chunk of profits a 1031.

What Is A 1031 Exchange Asset Preservation Inc

A 1031 exchange is similar to a traditional IRA or 401k retirement plan.

. A reverse exchange in real estate is a type of property exchange wherein the replacement property is acquired first and then the current property is sold. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. A reverse exchange was created to help.

In fact many investors secure two or three properties in case the first falls through. Also known as Like-Kind Exchanges a 1031 tax-deferred exchange is defined in section 1031 of the Internal Revenue Code. For example if the IRA investor mentioned above is in a 33 tax bracket she would have had to pay 3333 in income taxes on the 10000 earned on the IRA in 2001.

By completing an exchange the Taxpayer Exchanger can dispose of investment or business-use assets acquire Replacement Property and defer the tax that would ordinarily be due upon. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free. An example of a tax-deferred vehicle is a 401k plan.

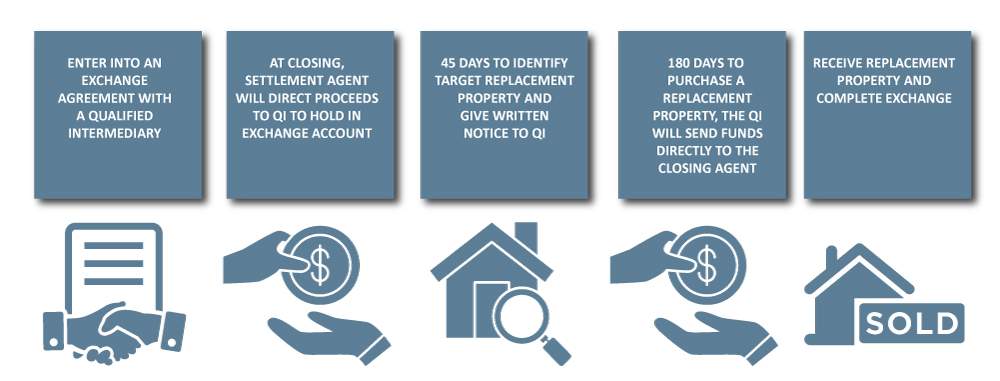

In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. Learn what a deferred 1031 exchange is and why its important. A like-kind exchange is a tax-deferred transaction allowing for the disposal of.

A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third 13 of your gain or profit toward the payment of your capital gain and depreciation recapture taxes. A deferred 1031.

However because IRAs are tax deferred the. Enter the 1031 Tax Deferred Exchange. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes.

A tax-qualified defined contribution account offered by employers to help grow employees retirement savings. The company also offers strategic advisory asset management. The company also offers strategic advisory asset management tax-deferred exchange and capital markets solutions.

Commonwealth of Massachusetts. Those taxes could run as high as 15 to 30 when state and federal taxes are combined. Its important to keep in mind though that a 1031 exchange may require a comparatively high minimum investment and holding time.

Adjective not taxed until sometime in the future. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. That would have left 6667 in capital gains in the account.

The theory behind Section 1031 is that when a property owner has reinvested the sale. Like-kind properties according to the IRS are properties of the same nature character or class. 2020 Instructions for Form 8824 Like-Kind Exchanges Page 1.

A tax-deferred exchange also referred to as a like-kind exchange a 1031 exchange a threeparty exchange or a Starker exchange may provide a way for you to take that 26000 apply it to the rental house purchase and delay the payment of the capital gains tax until you sell the new property. It is an excellent strategy for anyone who wants to build wealth from their. The Reverse Exchange is structured primarily with Revenue Procedure 2000-37 in mind.

If you would like to find out about the reverse exchange process or the tax deferred exchange process contact one of our experts today. The same principle holds true for tax-deferred exchanges or real estate investments. This property exchange takes its name from Section 1031 of the Internal Revenue Code.

It may take time to find and secure the right like-kind property. 5 Simple Ways to Invest in Real Estate. When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are deferred until the holder begins to cash out of the retirement plan.

This makes these transactions more ideal for individuals with a higher net worth. Section 1031 of the US. Reverse Exchange Definition.

At a 10 annual return those earnings would go on to produce 667 in 2002. Real Estate Definition. Although the numbers and.

A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction. A deferred exchange may help you capture tax benefits offered by a 1031 exchange. Specifically the tax code referring to 1031 Exchanges in IRC Section 11031 reads No gain or loss.

Handling earnest money deposits in a 1031 Exchange. Generally have to pay tax on the gain at the time of sale. 1031 Tax Deferred Exchanges Accessed April 10 2021.

The definition is vague. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Over the long term consistent and proper use of this strategy can pay.

A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction. There are of course very specific requirements that you must follow so that the sale of your relinquished. We want to help your 1031 exchange transaction go as smoothly as possible.

Ultimately the 1031 exchange is a completely legal tax-deferred strategy that any taxpayer in the United States can use.

6 Steps To Understanding 1031 Exchange Rules Stessa

Image Result For Finance Management Accounting And Finance Project Finance Finance

Pin On Printable Real Estate Forms 2014

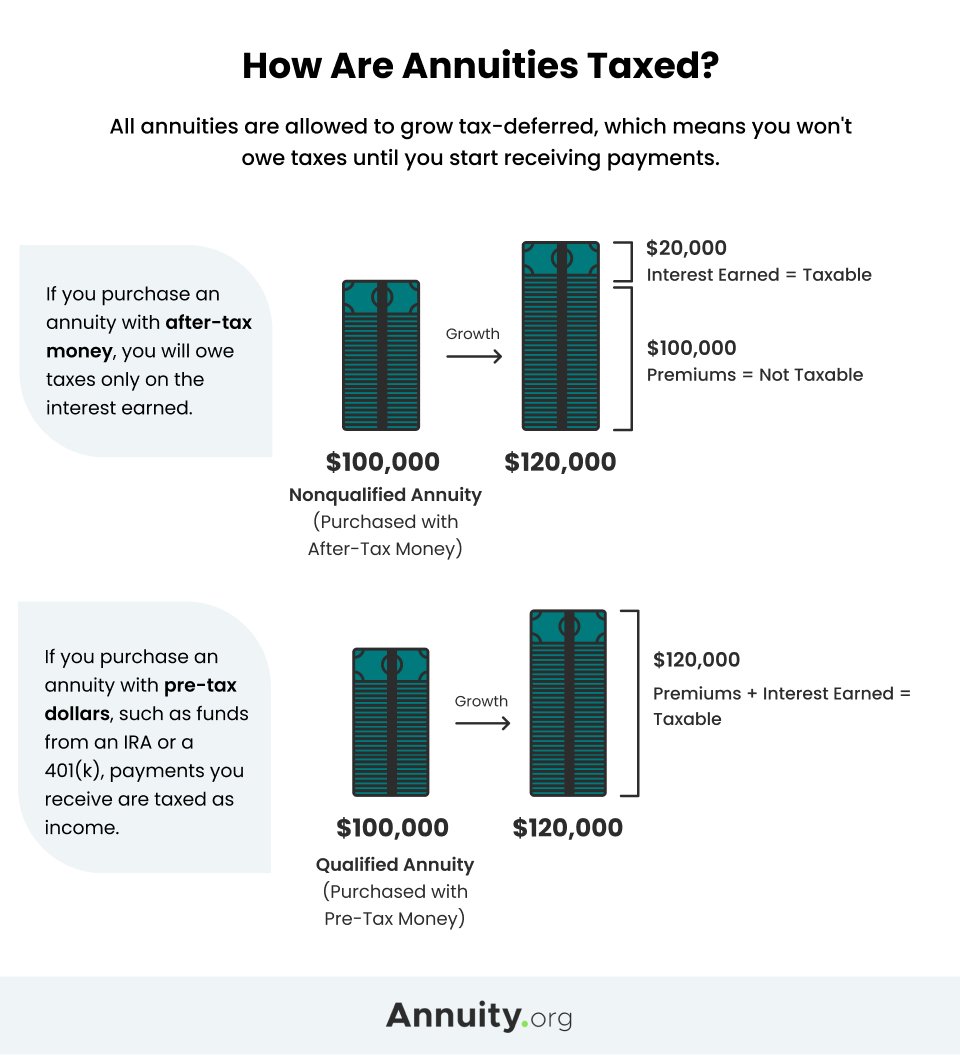

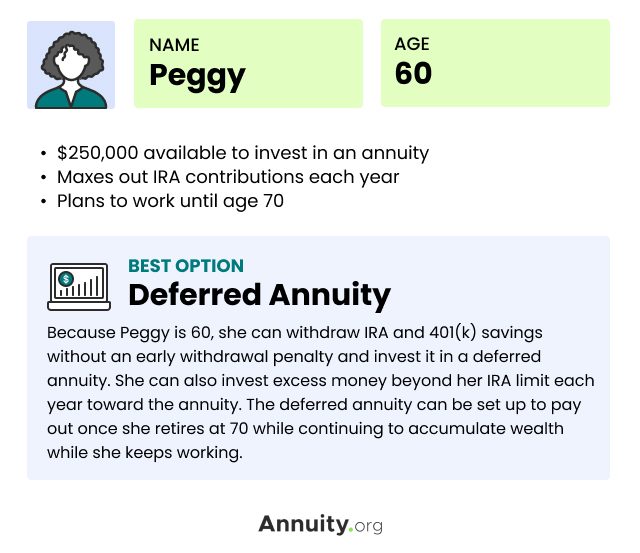

What Is A Deferred Annuity Pros Cons Of Deferred Annuities

What Is A 1031 Tax Deferred Exchange Kiplinger

What Is A 1031 Exchange Properties Paradise Blog

The Basics On 1031 Simultaneous Tax Deferred Exchanges 1031 Exchange Place

1031 Exchange Like Kind Exchange Definition What Is A 1031 Exchange Real Estate Investing Investing Capital Gains Tax

Investopedia 100 Top Financial Advisors Of 2019 Early Retirement Career Change Retirement Budget

1031 Exchange Explained What Is A 1031 Exchange

1031 Exchange When Selling A Business

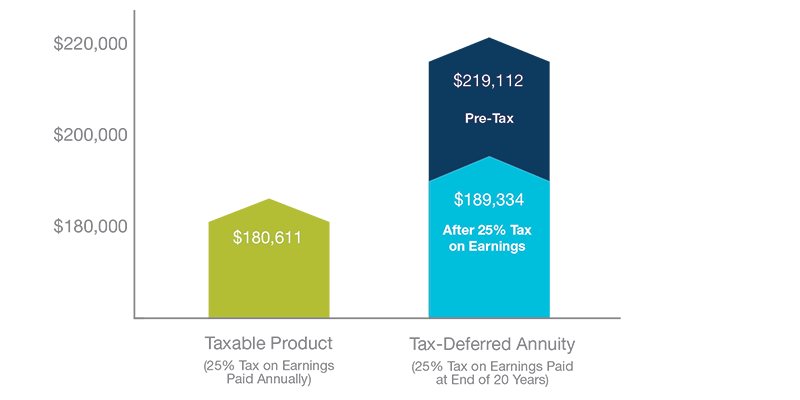

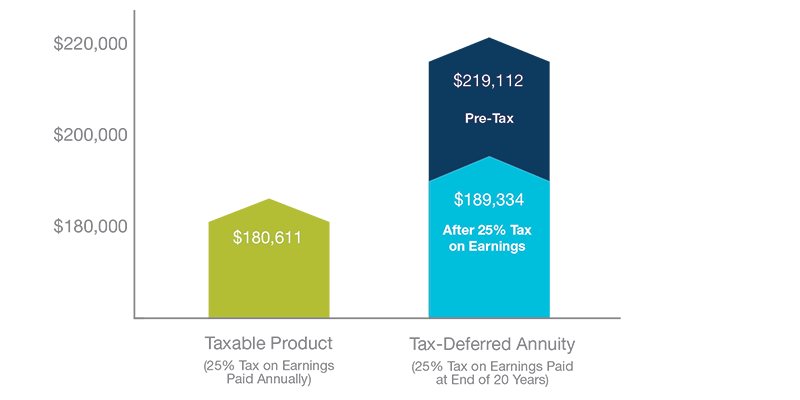

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Are You Eligible For A 1031 Exchange

The Basics On 1031 Simultaneous Tax Deferred Exchanges 1031 Exchange Place

Capital Employed Accounting And Finance Financial Management Shopify Business

What Is A 1031 Exchange Asset Preservation Inc